Course details

📌Learning Objectives

📌Learning Objectives

By the end of this course, students will be able to:

✅ Understand the fundamental concepts of FinTech and its applications.

✅ Analyze blockchain, cryptocurrencies, and digital banking innovations.

✅ Evaluate economic and statistical methods used in financial technology.

✅ Identify cybersecurity threats and privacy risks in digital finance.

✅ Explore emerging trends in InsurTech, digital payments, and RegTech.

📌 Course Prerequisites

🚀 Prerequisites for this Course:

Students should have a basic understanding of finance and financial concepts, foundational knowledge in statistical analysis and financial mathematics, and familiarity with business and entrepreneurship principles.

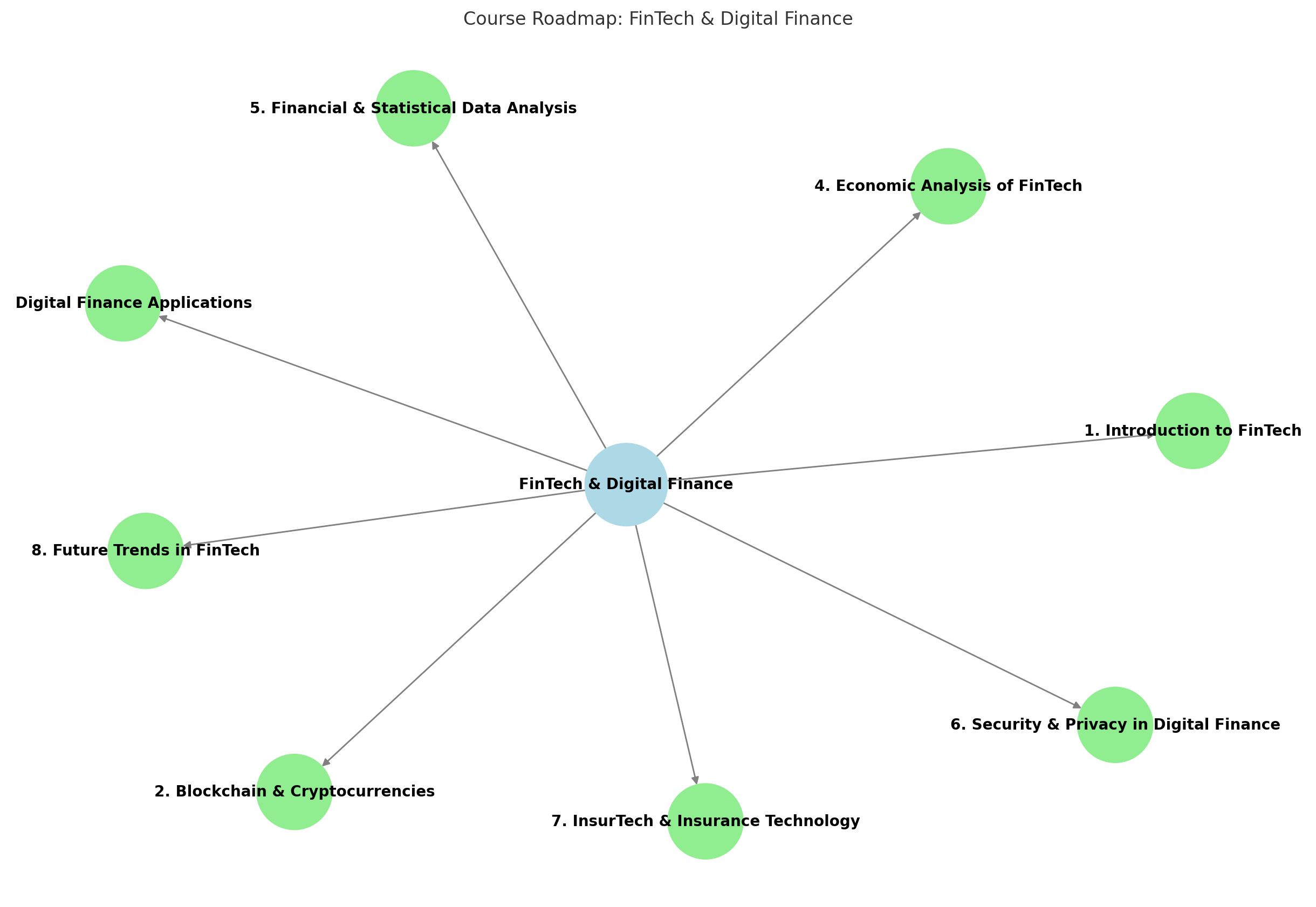

📌 Course Content

This course covers key areas of FinTech and Digital Finance, including:

1️⃣ Fundamental Concepts of FinTech & Digital Finance

2️⃣ Cryptocurrencies & Distributed Ledger Technology (Blockchain)

3️⃣ Applications of Digital Finance (Electronic Payments & International Transfers)

4️⃣ Economic Analysis of FinTech

5️⃣ Financial & Economic Data Analysis Using Modern Technologies

6️⃣ Statistical Analysis in FinTech

7️⃣ Security & Privacy in Digital Finance

8️⃣ FinTech & Digital Transformation in Banking & Insurance

9️⃣ Financial Platforms & Digital Markets

📌 Assessment Method

📊 Evaluation is based on:

- Continuous Assessment (40%) – Including research presentations, assignments, and practical exercises.

- Final Exam (60%) – Assessing conceptual and analytical understanding of FinTech topics.

Grade Calculation: The final course grade is weighted based on the proportion of lessons and assignments.